If you want to start an argument at your next business lunch, question the impact that marketing makes towards a company’s bottom line. I once heard the CFO of a Fortune 100 company say that he could cut all budgets for marketing tomorrow and sell just as many units of his globally-recognized product line.

He might have been right, in the current budget period. But over time the data would most definitely prove him wrong. His opinion, however, is a frequent complaint about marketing. How do you truly measure its impact? Is your company getting a good return on investment?

Times haven’t changed much. According to the Spring 2025 edition of The CMO Survey administered through a partnership with Deloitte, Duke University and the American Marketing Association, “demonstrating the impact of marketing on financial outcomes” is the #1 challenge managers say they need to address. Not far behind: “focusing data and analytics on the most important marketing problems.”

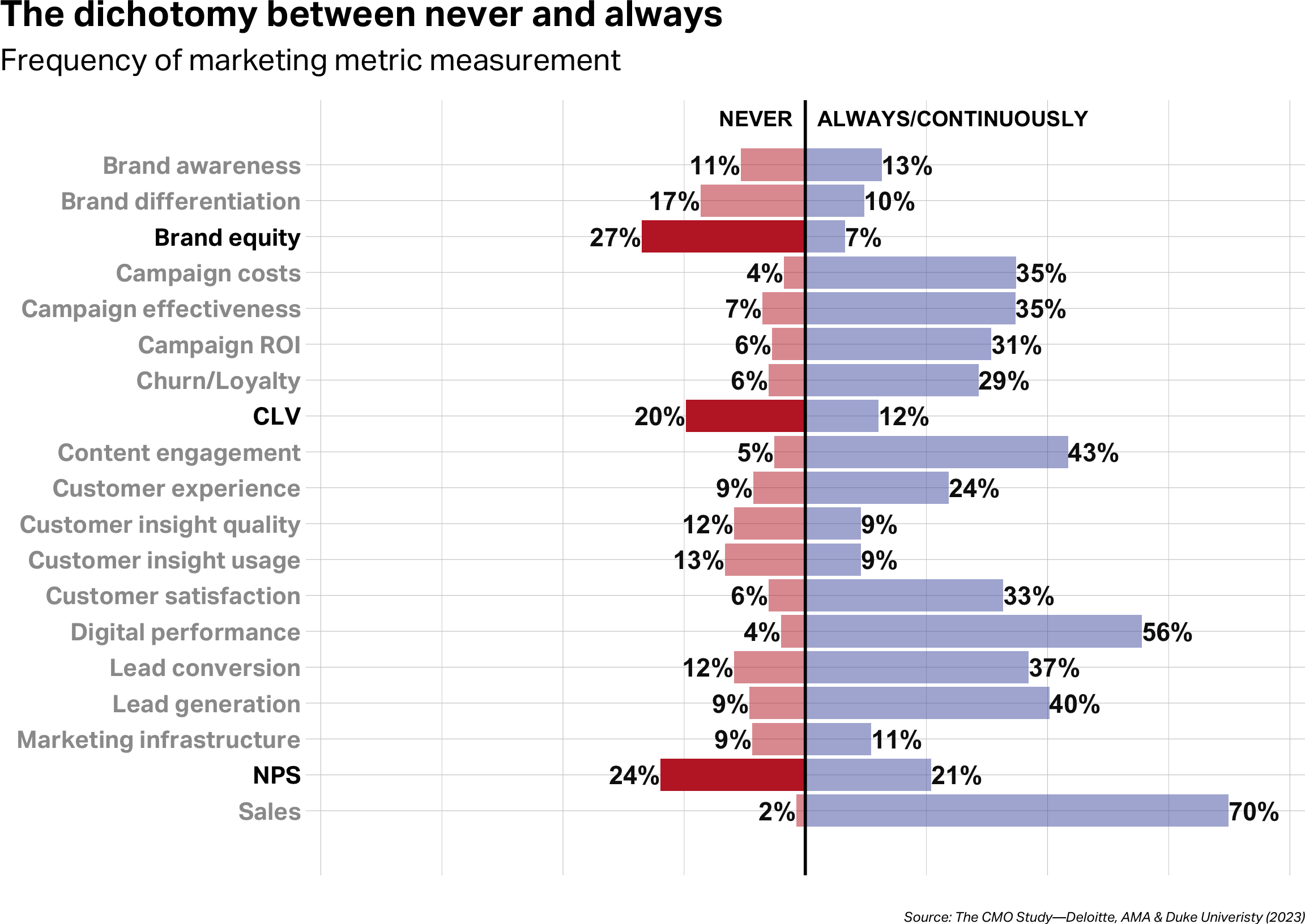

That’s the setup. This chart (from the 2023 edition of the same study) is the punchline.

Despite enormous pressure to validate performance, many marketers aren’t measuring what matters. One in five skip Customer Lifetime Value. More than a quarter ignore Brand Equity altogether. And nearly one in four don’t track Net Promoter Score, a valuable but also problematic metric that we’ll cover in a separate post.

These aren’t soft metrics. They’re fundamentals. And ignoring them leads to missed signals and bad decisions.

Notice which metrics are most frequently measured: sales, digital performance, and content engagement. These are valuable KPIs, but they don’t tell you why they’re working or who they’re working for. Without tracking Brand Equity, you miss the underlying forces driving preference. Without CLV, you risk optimizing engagement for the wrong audiences.

Brand Equity, for instance, is a powerful but lagging indicator. A McKinsey study found that brands with strong equity outperform the global market by 74% in total shareholder return over time. But because brand strength builds slowly and reveals itself late, many marketers underinvest in tracking it. When they do, they often focus too heavily on top-of-funnel metrics that are not very helpful in understanding impact on financial outcomes. What’s needed isn’t just recall and recognition metrics, but longitudinal tracking tied to customer profitability.

CLV provides a different lens: a forward-looking one. Understanding which customers drive the most value helps companies avoid wasted spend. One of our enterprise technology clients, for example, discovered their best-fit customers were already on the platform. That insight changed their strategy. Instead of investing in costly acquisition campaigns, they shifted focus to deeper segmentation—unlocking upsell, cross-sell, and retention strategies aimed squarely at customers with the highest projected lifetime value.

At Conclusive, we specialize in frameworks that connect these metrics to the business outcomes that matter most. Our custom-designed, open-source research methodology relies on experimental and longitudinal methods that surface what’s really driving results so that managers can make better investment decisions and optimize their marketing mix.

In today’s leaner organizational models—where even high-performing companies are trimming teams amid growth, as noted in a recent Wall Street Journal article—every hire, tool, and buck must deliver. While AI is reshaping how we work, smarter metrics are required to power smarter decisions.

With smaller, flatter teams, you don’t get the luxury of measuring everything. You need truths that cut to the core: metrics that tell you where you’re winning, where you’re bleeding, and what to double down on. That’s why Brand Equity and CLV are essential.

At Conclusive, we make it a point to tie insights back to business or financial impact. That’s the difference between guessing what works and knowing it works. On the quest for efficiency and effectiveness, marketers must measure what matters, prove what works, and then do more of it.